schedule c tax form meaning

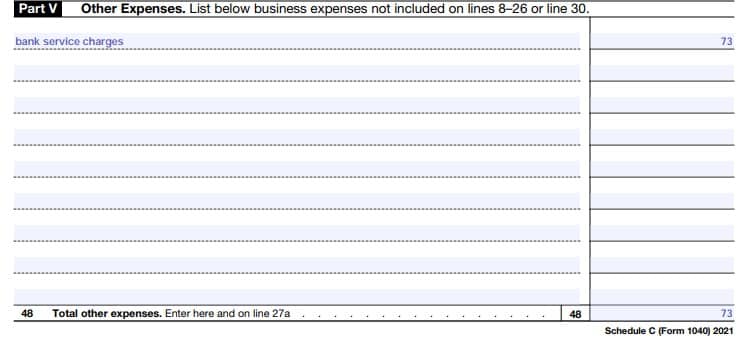

The 1040-SR is available for seniors over 65 with large print and a standard deduction chart. If you dont need the description you can delete that miscellaneous expense.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

Who should file a Schedule C form.

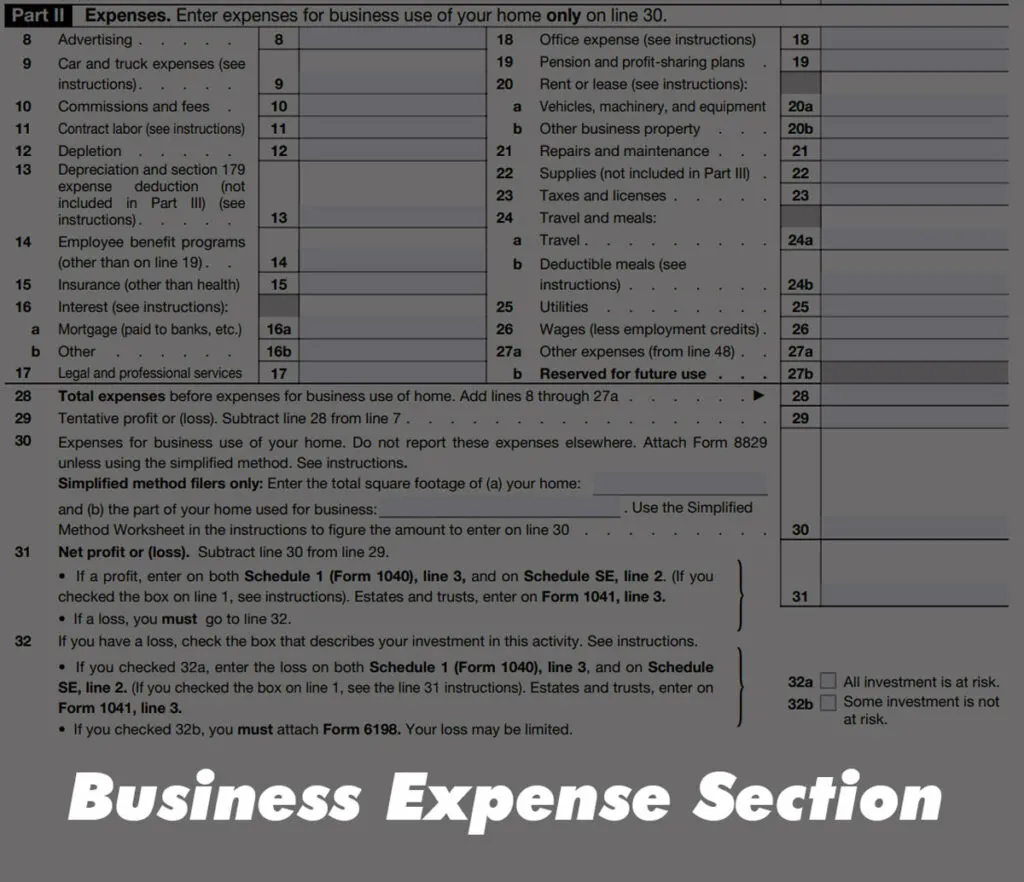

. Advertising - Amounts paid for business-related advertising. Click EditAdd next to your business. Here are a few tips for Schedule C filers.

Typically a sole proprietor files their personal and business income taxes together on one return. Schedule C is a sole proprietor tax form. A net profit or loss figure will then be calculated and then used on the proprietors personal income tax return on form 1040.

The profit is the amount of money you made after covering all of your business expenses and obligations. The IRS Schedule C form is the most common business income tax form for small business owners. If you wish to change your accounting method you need permission from the IRS.

An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity. About Form 3800 General Business Credit. Accrual accounting is the most common method used by businesses.

The revenue is recorded even if cash has not been received or if expenses have been incurred but no cash has been paid. Businesses that file Schedule C are pass-through entities meaning they pay tax using their owners Form 1040. Its used to report income from rental property partnerships S corporations and other types of supplemental income.

IRS Schedule C Profit or Loss from Business is a tax form you file with your Form 1040 to report income and expenses for your business. And regardless of whether you have a profit or loss youâll report this figure. The quickest safest and most accurate way to file is by using IRS e-file either online or through a tax professional that is an authorized IRS e-file provider.

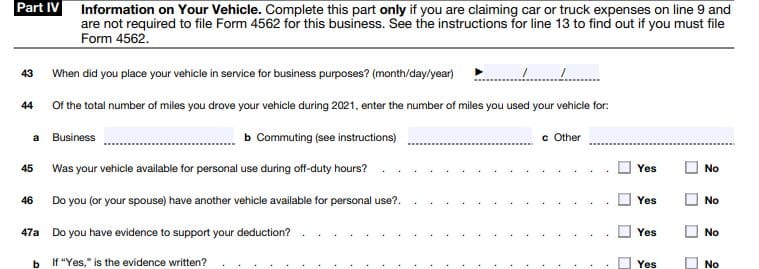

Legal Accounting or Professional Service s. If you use the same accounting categories as the IRS you can. Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor.

If you use accounting software Schedule C should closely match your profit and loss statement. The Schedule C form is designed to let sole proprietors write off as much of their expenses as possible from their tax bill in hopes. Schedule E is a tax form filed by individual business owners as part of their personal tax return preparation.

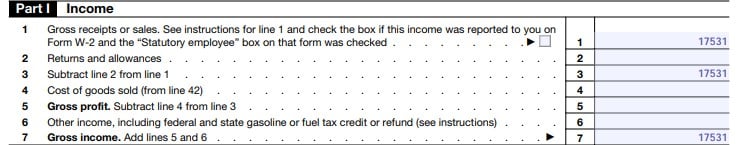

Before 2020 you would have reported those payments on Form 1099-MISC. The Schedule C is an IRS form that collects data about your small business and then calculates your net profit. After you calculate your income and expenses your Schedule C will show profits or losses.

This will help you complete your tax forms. Its used to report profit or loss and to include this information in the owners personal tax returns for the year. Click Review next to Other miscellaneous expenses.

Schedule C is used by small business owners and professionals who operate as sole proprietors to calculate their profit or loss for the tax year. This Schedule provides a recap of your companys income and expenses. This article discusses Schedule E what types of income it reports and how to complete and file this form.

The resulting profit or loss is typically considered self-employment income. If you receive a Form 1099-MISC 1099-NEC andor 1099-K you are likely to have to report it on Schedule C along with other. Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor.

About Form 1099-MISC Miscellaneous Income. An accounting method is chosen when you file your first tax return. The Schedule C tax form is used to report profit or loss from a business.

Otherwise enter an amount. If you have a profit you will need to pay both income and self-employment tax. Usually if you fill out Schedule C youll also have to fill out Schedule SE Self-Employment Tax.

You must send a copy of the 1099-NEC to the IRS. Schedule C - Accounting Method. The IRS allows you to deduct the cost of business-related expenses that are considered both ordinary and necessary in your trade or business.

Examples- Business cards flyers ad space etc. Income Tax Return for Estates and Trusts. It is a form that sole proprietors single owners of businesses must fill out in the United States when filing their annual tax returns.

This can encompass owning a digital or brick-and-mortar small business freelancing contracting and gig work such as ride-share driving. You must use the same accounting method from year to year. Click Edit next to your business.

On the other hand the accrual method accounts for revenue when it is earned and expenses goods and services when they are incurred. The IRS Schedule C form is an important form for business owners and sole proprietors. Find the miscellaneous expense that doesnt have an amount next to a description.

For 2019 and beyond you may file your income taxes on Form 1040. This is the amount the IRS taxes not your income. The net profit or loss from this schedule is reported on Form 1040.

That profit or loss is then entered on the owners Form 1040 individual tax return and on Schedule SE which is used to calculate the amount of tax owed on earnings from self-employment. An activity qualifies as a business if. Schedule C is a place to record the revenue from your business and all the costs associated with running your business.

Commission and Fees - Amounts paid for services rendered on behalf of your business. An accounting method is the method used to determine when you report income and expenses on your return. You must send Form 1099-NEC to those whom you pay 600 or more.

About Form 1041 US. Schedule C is the form used to report income and expenses from self-employment. You will need to file Schedule C annually as an attachment to your Form 1040.

View solution in original post. Schedule C is an important tax form for sole proprietors and other self-employed business owners. A Schedule C form is a detailed form as figures for income expenses and cost of goods sold all need to be recorded.

Payments to contractors freelancers or other small-business people can go on Line 11. In 2018 the last year reported more than 27 million small business owners filed their tax returns using Schedule C. The form is used as part of your personal tax return.

What Is A Schedule C Irs Form Turbotax Tax Tips Videos

Form 1040 Sr U S Tax Return For Seniors Definition Tax Forms Irs Tax Forms Ways To Get Money

How To Fill Out Your 2021 Schedule C With Example

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

How To Fill Out Your 2021 Schedule C With Example

How To Fill Out Your 2021 Schedule C With Example

What To Know About Filing A Business Tax Extension Businessnewsdaily Com Tax Extension Tax Refund Tax Day

How To Fill Out Schedule C For Doordash Independent Contractors

Business Activity Code For Taxes Fundsnet

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

How To Fill Out Your 2021 Schedule C With Example

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

How To Fill Out Your 2021 Schedule C With Example

Form 1040 U S Individual Tax Return Definition Irs Tax Forms Income Tax Return Tax Forms

How To Fill Out Schedule C For Doordash Independent Contractors

How To Fill Out Your 2021 Schedule C With Example